Quick Take

In August, several publicly traded Bitcoin miners provided updates on their production and operations.

RIOT reported producing 322 BTC, a 13% decrease compared to July. However, the company increased its Bitcoin holdings by 3%, bringing the total to 10,019 BTC. RIOT’s deployed hash rate stood at 23.5 EH/s, while its operational hash rate was 14.5 EH/s. The lower operational hash rate was influenced by power and demand response credits amounting to $6.4 million. Their total power cost was 2.6 cents per kWh.

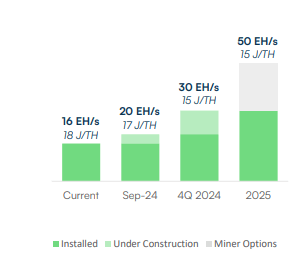

Meanwhile, IREN mined 245 BTC in August, marking a 10% increase month-over-month. The company installed 16 EH/s and remains on track to achieve 30 EH/s by Q4, with plans to reach 50 EH/s by 2025. IREN also reported a significant reduction in electricity costs per Bitcoin mined, from $61,677 in July to $29,958 in August, thanks to a transition to spot pricing. Their AI cloud services continued to grow, with more revenue and customers. IREN remains financially strong, with $405 million in cash and no debt.

While Core Scientific experienced a 14% drop in production, mining 358 BTC in August, the company reported a total energized hash rate of 25.4 EH/s.

Be the first to comment