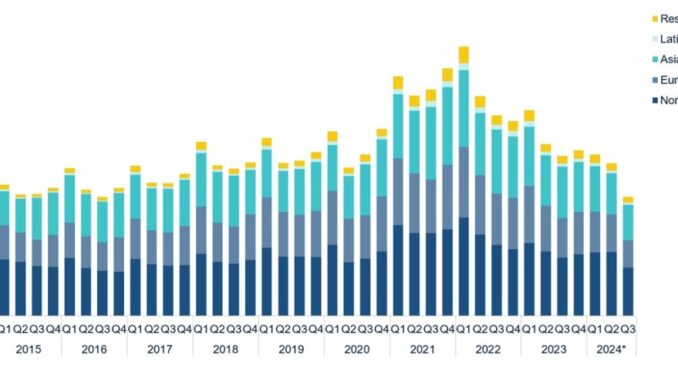

Global venture capital activity declined in Q3, confirming that 2024 will be another weak year for venture investments and exits, according to the Q3 2024 Pitchbook/NVCA Venture Monitor First Look.

By just about every number, Q3 was weak and 2024 overall doesn’t compare well in terms of numbers of deals, average deal size, VC fundraising, exits and dollar amounts raised. No particular region stood out in terms of great performance, based on the report from Pitchbook and the National Venture Capital Association.

PitchBook’s lead VC analyst Kyle Stanford said in a statement that dealmaking in the U.S. showed its first quarter-over-quarter decline in a year. Just an estimated 3,777 VC investment deals were completed during the quarter, falling back to pre-2021 levels.

The median valuations for these stages is high, but there has been upward pressure on the figure due to previous high multiple valuations for companies now finally coming back to raise again. Deal value during Q3 was lowest of the year due to few outsized rounds being raised. Median deal sizes have also seen anuptick from 2023, but they remain well below the median from 2021. Stronger companies raising capital are receiving larger deals to help weather the market slowdown.

Join us for GamesBeat Next!

GamesBeat Next is almost here! GB Next is the premier event for product leaders and leadership in the gaming industry. Coming up October 28th and 29th, join fellow leaders and amazing speakers like Matthew Bromberg (CEO Unity), Amy Hennig (Co-President of New Media Skydance Games), Laura Naviaux Sturr (GM Operations Amazon Games), Amir Satvat (Business Development Director Tencent), and so many others. See the full speaker list and register here.

Exits continued to find little in terms of success in the market. Just 10 companies went through a public listing in the U.S., and $11.2 billion in total exit value was created during the quarter. The large number of companies that remain stuck in the private market are weighing on distributions back to limited partners, which causes further challenges within VC.

Stanford said, in perhaps the only bright spot, was that the rate cut from the Federal Reserve in September is a good step to balancing costs of borrowing and relieving pressure on public markets thatcould help begin the registration process for companies moving forward. M&A remains slow, due to both regulatory pressures and market conditions.

With one quarter left, 2024 is pacing for the second slow year. Just $64.0 billion has been raised across U.S. VC funds. The low commitments are connected to the low distributions and poor returns that the strategy has provided over the past few years. Although fundraising figures are on par with 2020, the number of companies currently private, VC-backed adds strain to capital resources for the market. LPs have committed a large proportion of the capital to established managers and large funds, which consolidates opportunities for companies, and investment decision making with fewer groups.

Pitchbook’s VC analyst Nalin Patel said that in Europe in Q3 2024, VC deal activity was slightly down from the second quarter. Despite an uptick in deal value in Q2, Q3 marked a slight dip. Nonetheless, activity has stabilized since declining from peaks. Deal counts were marginally down QoQ, further demonstrating that fewer deals are closing as investors remain selective about their investments. There are encouraging signs heading into the end of 2024, with monetary policy loosening and inflation rates normalizing.

Exit value through Q3 2024 has surpassed the annual figure from 2023, providing optimism within markets. Major VC-backed exits in the past two years have been scarce and a rebound could be on the horizon if public markets pick up. Risk remains a key consideration for exits in terms of valuation, returns, and volatility. Founders and investors would not want to lose significant amounts of value from portcos that has been built up over several years.

The fundraising run rate through Q3 2024 is tracking flat from the 2023 full-year showing. Macroeconomic conditions as well as the tough exit environment have made fundraising tricky. Larger funds have closed in 2024 but capital remains locked into portfolio companies that could be due an exit. We could see fundraising increase in 2025 if exits pick up and capital is recycled back into VC funds.

In Asia, Stanford said venture activity continues its slow 2024. Just $14.9 billion was invested during thequarter, the lowest figure since Q1 2017. The deep decline of China’s venture market has had a major impact on the overall financing market. Other markets such as India and Southeast Asia have not kept up pace, either. Asia deal count in Q3 (2,143) was less than half the high mark in Q4 2021 (4,704), Stanford said.

Asia supported the highest exit value of any region in Q3, boosted by the IPO of India’s Ola Electric, which added more than $3 billion to the figure. Four of the top six largest exits of the quarter occurred in Asia, all IPOs.

Asia’s fundraising has remained subdued, with just $53.1 billion committed to the strategy within the Asia markets in during the first three quarters of the year. 2024 will likely close on par with 2023’s fundraising total of $84.8 billion. That would make the past two years the only years under $100 billion in total commitments for Asia since 2017.

And in Latin America, Stanford said dealmaking activity has been slow through Q3, a drag being that much of the high activity levels were reliant on non-domestic investors that have pulled back to their classic strategies and investment geographies. The lack of exits by Latin American companies has increased the risk of investments in the market. Just $1.0 billion was invested in the market during Q3, and the year is paced for just over $4 billion in total investment.

Similar to, but more exacerbated than the rest of the world, fundraising has been hurt by the lack of exits and low distributions coming back to LPs. Because of this higher risk, LPs have looked to diversify into other markets or strategies. Just 10 funds have been closed in Latin America during the year. The year may become the lowest for total commitments in the past decade.

Be the first to comment