Onchain Highlights

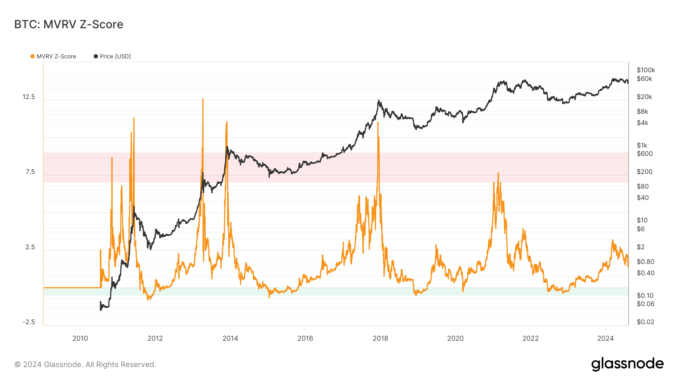

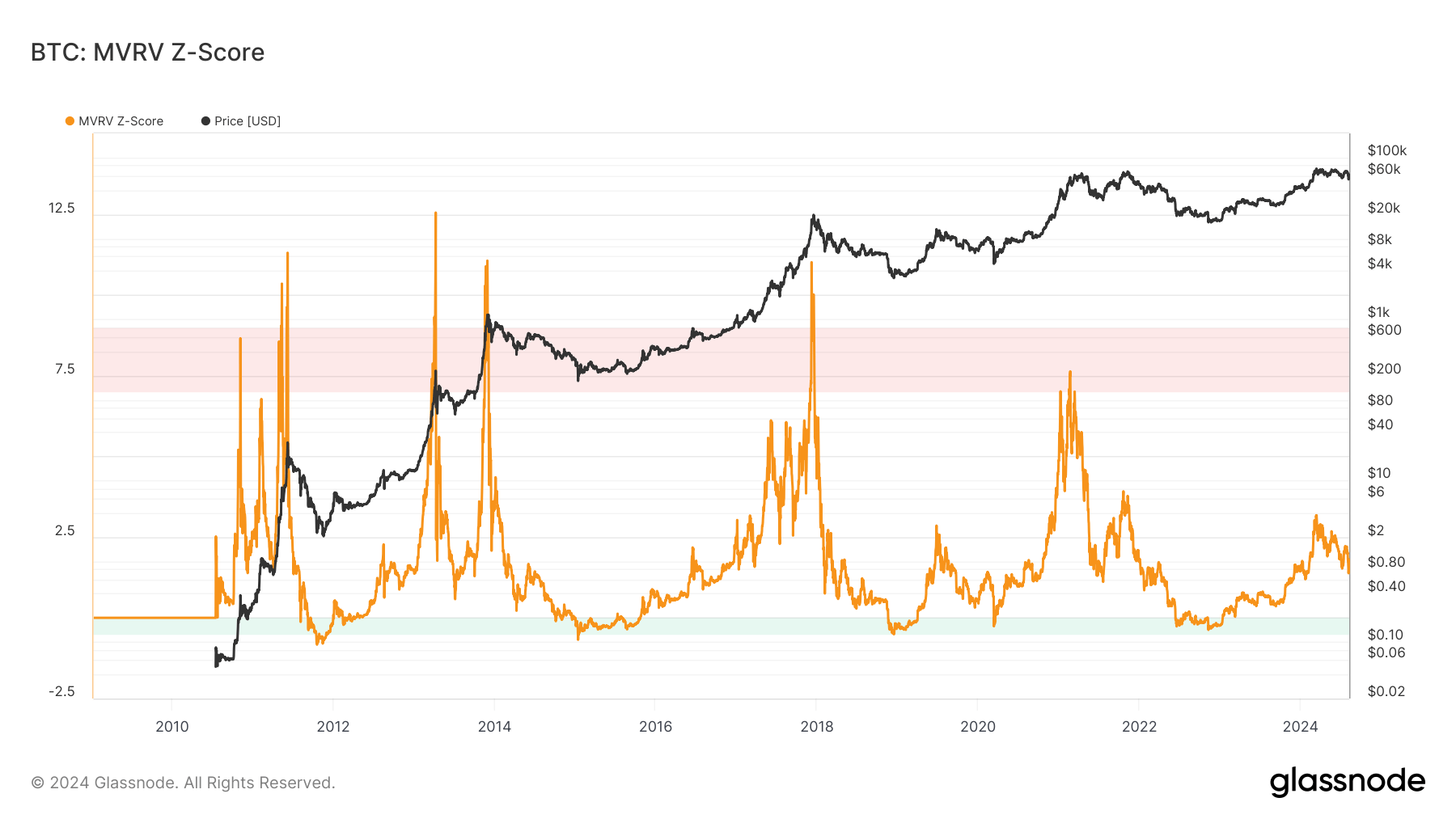

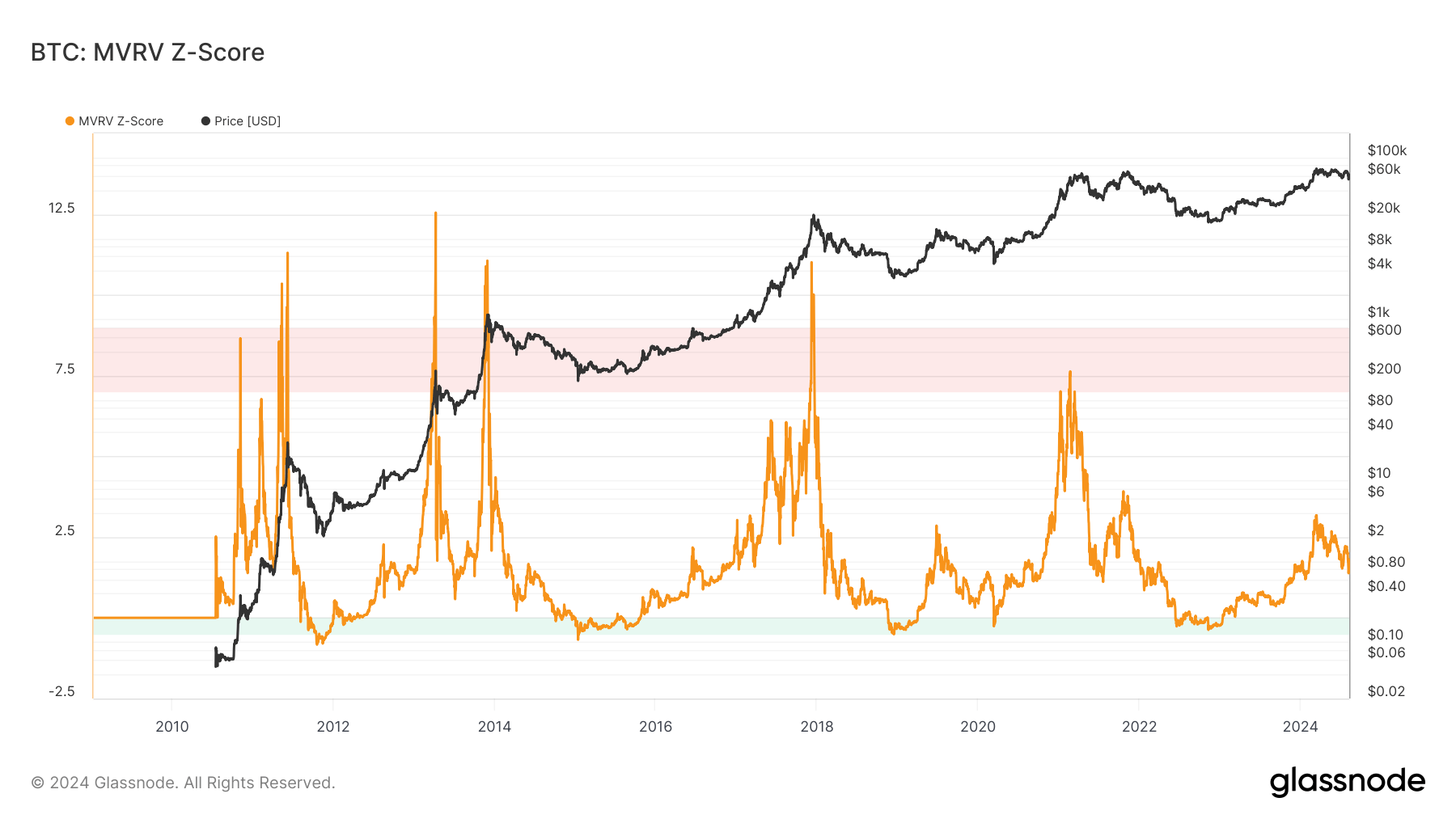

DEFINITION:The MVRV Z-Score evaluates whether BTC is overvalued or undervalued relative to its “fair value”. Instead of using a traditional z-score method, the MVRV Z-Score uniquely compares the market value to the realized value. When the market value, measured as network valuation by spot price multiplied by supply, is significantly higher than the realized value, represented by the cumulative capital inflow into the asset, it has typically signaled a market top (red zone). Conversely, a significantly lower market value than the realized value has often indicated market bottoms (green zone).

Bitcoin’s MVRV Z-Score indicates that it is nearer to undervalued levels, reflecting a potential buying opportunity. Over the past year, the metric has shown significant fluctuations, mirroring Bitcoin’s volatile price trends.

After reaching a high of roughly 3 in March, coinciding with Bitcoin’s pre-halving surge above $70,000, the Z-Score has since declined sharply. This drop suggests that the market is moving away from potential overvaluation and closer to levels historically associated with undervaluation.

As the Z-Score trends towards the lower end, it signals that Bitcoin may be approaching a period where it is undervalued relative to its realized value. Historically, Z-Score values around 0 have indicated market bottoms, suggesting that Bitcoin’s current position might offer a favorable entry point for long-term investors.

Be the first to comment